by Brad Jackson | Jun 18, 2018 | Update

Organizers of the 2018 Timber Processing & Energy Expo (TP&EE) announce that free online registration is now open for the big machinery event to be held October 17-19 at the Portland Exposition Center in Portland, Ore. Approximately 190 exhibitors will display equipment and technologies catered to the structural veneer, plywood, mass timber, engineered wood products and lumber industries. Held every other year, this is the fourth TP&EE hosted by Panel World and Timber Processing magazines, and produced by Hatton-Brown Expositions LLC. Personnel from wood products companies and mills registering online receive free admission to all three days of TP&EE. (Walk-up fee is $20 per day). Those with equipment companies who are not exhibiting are required to pay a fee.The 2016 TP&EE attracted 1,600 non-exhibitor personnel, representing 110 wood products producer companies and hundreds of individual mill operations. “There is tremendous action in the plywood and lumber industries right now, and we anticipate this TP&EE will be the busiest yet as mills continue to take advantage of excellent building products markets and wood products prices,” comments Show Director Rich Donnell. Register at www.timberprocessingandenergyexpo.com

by Brad Jackson | Mar 6, 2018 | Update

An Oregon district judge has refused to dismiss a 2016 lawsuit filed by counties with state forests within their borders that claimed state officials have refused to maximize timber revenues from lands that counties donated to the state years ago. Attorneys for the state had claimed “sovereign immunity” in the matter—a doctrine that county governments can’t sue the state government—and while the judge initially allowed it as a possible defense, his most recent ruling says that in this case, counties can sue the state to enforce their contract rights.

At issue are timber sale revenues from state lands that were initially donated to the state decades ago, along with accompanying legislation that the lands should be managed for the “greatest permanent value” and revenues shared with the counties. According to the suit, state forestry officials began reducing timber revenues in favor of recreational and environmental protection priorities 20 years ago via an internal policy change. As a result, the counties believe they have been shortchanged and are asking the state for more than $1 billion in revenues.

The judge’s ruling clears the way for the trial to begin, says counties’ attorney John DiLorenzo, adding that maybe the Oregon Dept. of Forestry will now take the case seriously, claiming that until now the state had treated the suit with derision, believing it would be easily dismissed.

by Brad Jackson | Oct 12, 2017 | Update

The sixth Panel & Engineered Lumber International Conference & Expo (PELICE) will celebrate its 10-year history as part of the event to be held April 13-14, 2018 in the Grand Ballroom North of the Omni Hotel at CNN Center in downtown Atlanta, Georgia, USA.

Held every other year, and hosted by Panel World magazine, the first PELICE took place in 2008. All of them have been held at the Omni Hotel, though participants will remember the first one in 2008 occurring on three levels of the hotel, before the event settled into the Grand Ballroom North in ensuing years.

“It was not the best of times,” comments Rich Donnell, co-chairman of PELICE and editor-in-chief of Panel World magazine. “In fact, it was the worst of times as the Great Recession began hitting its stride.” But Donnell notes that the producer and supplier segments of the industry showed up to support the event nonetheless.

“PELICE remains unique in that it brings together the structural and non-structural industries,” Donnell says. “When the conference ends I think people leave with a real feel for the big picture, in addition to accumulating the information they need to make improvements to their operations.”

Donnell expects PELICE 2018 to represent the positive momentum of the building products industry. “We continue to look at 1.2 million housing starts or so in the U.S., but there remains that untapped potential to get to that 1.5 or higher mark.”

What it’s going to take to make that happen will be one of the points addressed by Roger Tutterow, professor of economics and director of the Econometric Center at Kennesaw State University. Tutterow, who last spoke at PELICE in 2014, is highly regarded for his financial expertise, economic forecasts and statistical modeling because of their pinpoint accuracy.

“He also brings a lot of energy and humor to his presentations,” Donnell adds. “We feel very fortunate to be able to have him on our program.”

As it was at PELICE in 2016, the subject of ongoing mill projects will continue to be a theme of PELICE 2018. One of the keynoters who will address his company’s recently announced project is Grady Mulbery, president and CEO of Roseburg Forest Products.

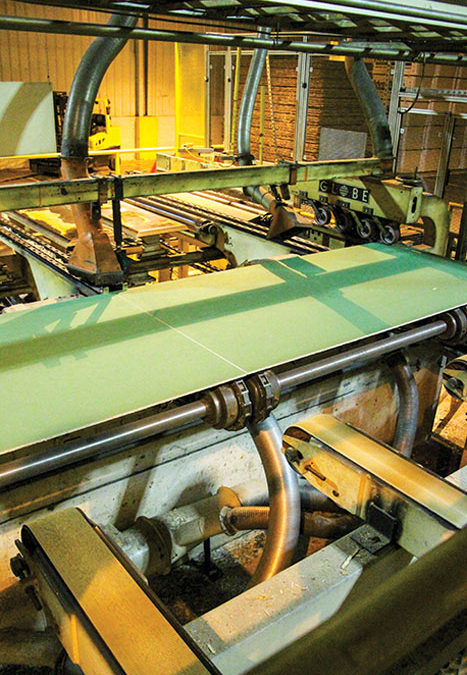

Roseburg, based in Oregon, plans to build a laminated veneer lumber facility in Chester, SC. Groundbreaking is planned in early 2018 with operation startup in mid 2019. Roseburg is no stranger to LVL and engineered wood products, as it has been operating a large plant in Riddle, Ore. since 2001.

In addition to addressing ongoing projects, PELICE will look at recently completed projects, such as the new Swanson Group plywood mill in Springfield, Ore. and Winston Plywood & Veneer’s new plywood facility in Louisville, Miss., with representatives from those companies speaking about the evolvement of the projects, high points and low points, lessons learned, workforce practices and getting into post-startup.

PELICE will also address cross-laminated timber and mass plywood panel. While much of the CLT momentum has been generated in the Northwest, the announcement this summer by International Beams to build a CLT facility in Alabama brings the discussion into the southern pine belt. Representatives from International Beams will address the marketing potential of the southern pine CLT product as well as the manufacturing intricacies.

And while CLT has come on strong, Freres Lumber in Oregon is starting up a plant to manufacture an alternative product it calls Mass Plywood Panel. A representative from Freres will speak about their new manufacturing plant and further developments in the marketplace.

Addressing the big picture and potential of “Tall Wood Construction” in a keynote talk will be Bob Glowinski, president and CEO of American Wood Council. He’ll discuss what is being done to take it into the mainstream under U.S. building codes.

Speaking of alternative products, a representative from CalAg will speak about that company’s ongoing construction of a rice straw-based medium density fiberboard plant in Willows, Calif. “This herculean effort required 20 years of absolute never-say-die commitment from the principals involved,” Donnell comments.

Other PELICE sessions will address various aspects of panel production, including resins and adhesives, fire prevention, air emissions control, dry end technologies, quality control and others. The specific timeline agenda will be announced soon as presentation proposals continue to come in.

PELICE 2016 attracted 450 industry professionals including representatives from 32 wood products producer companies worldwide. They heard 50 presentations and viewed 80 equipment and technology exhibitor sponsors. Donnell says they’ve added several more exhibitor spaces for 2018.

PELICE exhibitors are broken into Gold, Silver and Bronze sponsorships. As of late September, Gold sponsors included B&W MEGTEC, Dieffenbacher USA, Hexion, Sandvik, Siempelkamp and Sigma Thermal-TSI.

Silver sponsors include Atlantic Combustion, Argos Solutions, Baumer Inspection, Biele, Brunette Machinery, Cogent Industrial Technologies, Con-Vey, Dustex Lundberg, Electronic Wood Systems, Georgia-Pacific Chemicals, Globe Machine, Grenzebach, IMA Schelling, IMAL-PAL, Limab North America, Matthews Marking Systems, Meinan Machinery Works, MoistTech, NESTEC, Pallmann Industries, Player Design Inc., Process Combustion, SolaGen, SonicAire, Spraying Systems, SUGIMAT, Timber Products Inspection, Venango Machine/Custom Engineering, Westmill Industries, Willamette Valley Co.

Bronze sponsors include Automation Industries, CMA Engineering, Continental Conveyor, Flamex, Georgia Forestry Commission, GreCon, Hardwood Plywood & Veneer Assn., Mid-South Engineering, Process Sensors, Rodewisch, Steinemann Technology, TANN Corp., Wechsler Engineering and West Salem Machinery.

As usual, PELICE will be preceded by the fifth Wood Bioenergy Conference & Expo on April 11-12, and nearly half of the PELICE exhibitors also exhibit in the Wood Bio event as combo sponsors.

For exhibitor sponsorship information, e-mail: [email protected]. For presentation information, e-mail: rich@hatton brown.com.

Oregon-based Roseburg Forest Products will expand its operations in the Southeastern U.S. with construction of a new engineered wood products plant in Chester, SC.

Oregon-based Roseburg Forest Products will expand its operations in the Southeastern U.S. with construction of a new engineered wood products plant in Chester, SC.